Global Bicycle Components Aftermarket: 2026-2036 Strategic Outlook

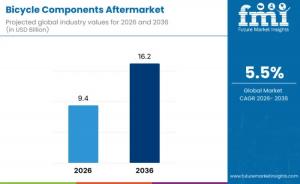

The bicycle components aftermarket is expected to grow from USD 9.4 billion in 2026 to USD 16.2 billion by 2036, at a 5.5% CAGR.

NEWARK, DE, UNITED STATES, February 2, 2026 /EINPresswire.com/ -- The global bicycle components aftermarket is entering a transformative decade. As of January 2026, the industry is valued at USD 9.4 billion and is projected to reach USD 16.2 billion by 2036, sustained by a 5.5% CAGR. This growth reflects a fundamental shift in how bicycles are perceived: moving from simple recreational toys to essential tools for high-performance fitness and sustainable urban mobility.

Consumer Demographics and Participation

Understanding the rider is as critical as understanding the machine. Current data reveals a diversifying global and domestic (USA) cycling landscape. While historical trends often framed cycling as a homogenous hobby, 2026 statistics show significant shifts in participation across racial and ethnic lines.

Global and US Diversity Trends

According to recent industry reports, the global cycling population is becoming increasingly diverse, though representation varies by region:

• White/Caucasian: Historically the largest group, representing approximately 78% of the global cycling population.

• Hispanic/Latino: A rapidly growing segment, accounting for roughly 11.5% of core participants in the US, with participation growing by 11.8% year-over-year.

• Black/African American: Represents approximately 8% of regular cyclists. Notably, this demographic saw a 12.8% increase in participation over the last year, the highest growth rate among any racial group.

• Asian/Pacific Islander: Comprises about 5.4% of the active rider base.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-5829

Gender and Age Dynamics

• Gender: Men continue to lead the aftermarket spending, holding roughly 57% of the market share. However, female participation reached a record high of 51.9% in 2023, signaling a massive opportunity for components tailored to female ergonomics (saddles, narrower handlebars, and reach-adjusted brake levers).

• Seniors: The "Silver Cyclist" trend is real. Participation for those aged 65+ grew by 11.5% recently, largely driven by the accessibility of e-bikes, which require specialized aftermarket support for batteries and motors.

Key Market Segments: Drivetrains & Road Bikes

The Drivetrain Dominance (38% Share)

The drivetrain—comprising the chain, cassette, derailleurs, and crankset—remains the heart of the aftermarket. Because these parts are "consumables" (subject to friction and wear), they command the highest replacement frequency.

• Trend: The shift toward 1x (single chainring) systems and wireless electronic shifting (like Shimano Di2 or SRAM AXS) has increased the average unit value of aftermarket sales.

Road Bikes: The Premium Catalyst (35% Share)

Road cycling remains the primary driver for high-margin, premium components. Road enthusiasts are statistically more likely to invest in "marginal gains," such as:

• Ceramic bearings for reduced friction.

• Carbon fiber wheelsets for aerodynamic efficiency.

• Power meters for data-driven training.

Regional Growth Analysis (2026–2036)

Between 2026 and 2036, the bicycle components aftermarket is set for steady expansion, with growth patterns tailored to each region’s unique infrastructure and consumer culture. The United States leads the developed markets with a projected 5.1% CAGR, primarily fueled by the massive adoption of e-bikes for urban commuting and significant government investment in cycling-friendly infrastructure across major cities. In the United Kingdom, the market is expected to grow at 4.6%, supported by "green" government subsidies and the rapid expansion of dedicated urban cycling lanes designed to meet net-zero carbon targets.

In Asia, growth is driven by a mix of scale and sophistication. China is projected to achieve a 4.1% CAGR, largely due to a burgeoning middle class seeking premium upgrades and the country's status as a global leader in e-bike adoption. Japan follows closely with a 4.2% CAGR, sustained by a deep-rooted cycling culture and a focus on high-end precision manufacturing for replacement parts. Finally, South Korea is expected to see a 4.0% CAGR, as a tech-savvy population increasingly prioritizes "smart" bike components—such as integrated GPS and electronic shifting—marking a shift toward high-performance and connected cycling ecosystems.

Industry Drivers and Challenges

Major Drivers

1. The E-Bike Revolution: E-bikes are not just bikes with motors; they are higher-stress machines. They require heavier-duty chains, reinforced tires, and specialized braking systems, significantly increasing the frequency and value of aftermarket visits.

2. Sustainability: Increasing environmental awareness is pushing consumers away from cars and toward bicycles for the "last mile" of commuting.

3. Technological Integration: Integration of GPS, IoT sensors, and mobile app connectivity into components is creating a "smart" aftermarket.

Strategic Restraints

• Counterfeit Risks: The rise of high-quality "chinesium" or counterfeit carbon frames and components poses a safety risk and erodes brand trust.

• Supply Chain Complexity: Reliance on specialized raw materials (carbon fiber, rare-earth magnets for motors) leaves the market vulnerable to geopolitical shifts.

• Standardization Issues: The lack of universal standards for bottom brackets, axle sizes, and battery mounts can frustrate consumers and complicate retailer inventory.

Competitive Landscape

The market remains a battleground for engineering excellence.

• Shimano Inc.: The undisputed leader in drivetrain and braking consistency.

• SRAM LLC: The primary challenger, leading the charge in wireless technology and mountain bike innovation.

• Campagnolo: Maintains a "luxury" niche, focusing on Italian heritage and premium aesthetics.

• Emerging Tech: Companies like Garmin and Wahoo are increasingly relevant in the aftermarket as "components" now include digital ecosystems and sensors.

Industry Note: Success in the 2030s will depend on "Circular Economy" initiatives. Manufacturers that offer component recycling or "re-manufacturing" programs will likely gain favor with the increasingly eco-conscious Gen Z and Millennial demographics.

Similar Industry Reports

Korea Bicycle Component Aftermarket Analysis

https://www.futuremarketinsights.com/reports/bicycle-component-aftermarket-analysis-in-korea

Japan Bicycle Component Aftermarket

https://www.futuremarketinsights.com/reports/bicycle-component-aftermarket-analysis-in-japan

Two-Wheeler Aftermarket Components & Consumables Market

https://www.futuremarketinsights.com/reports/two-wheeler-aftermarket-components-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.